COVID-19’s Impact on First-Time Homebuyers

With the onset of the COVID-19 Pandemic, the first quarter of 2020 marked an important turning point in the economy and housing market. Instead of our usual format, this edition of the first-time homebuyer report covers both the Q1 market and developments in April and May.

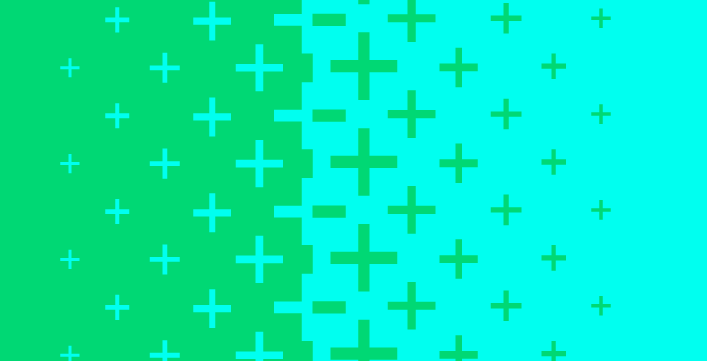

The first-time homebuyer market started the year strong with the purchase of 456,000 single-family homes (Figure 1a), up 14 percent from a year ago. The number of first-time homebuyers also showed strong momentum, reaching seasonally adjusted annual rates of 2.24 million in Q1 (Figure 1b) – their fastest pace since 2006.

First-time homebuyers enjoyed improved housing affordability in Q1, as mortgage rates for first-time homebuyers decreased between December and March to end at their lowest levels since 2013. The monthly principal and interest cost for first-time homebuyers decreased by 7 percent from a year ago.

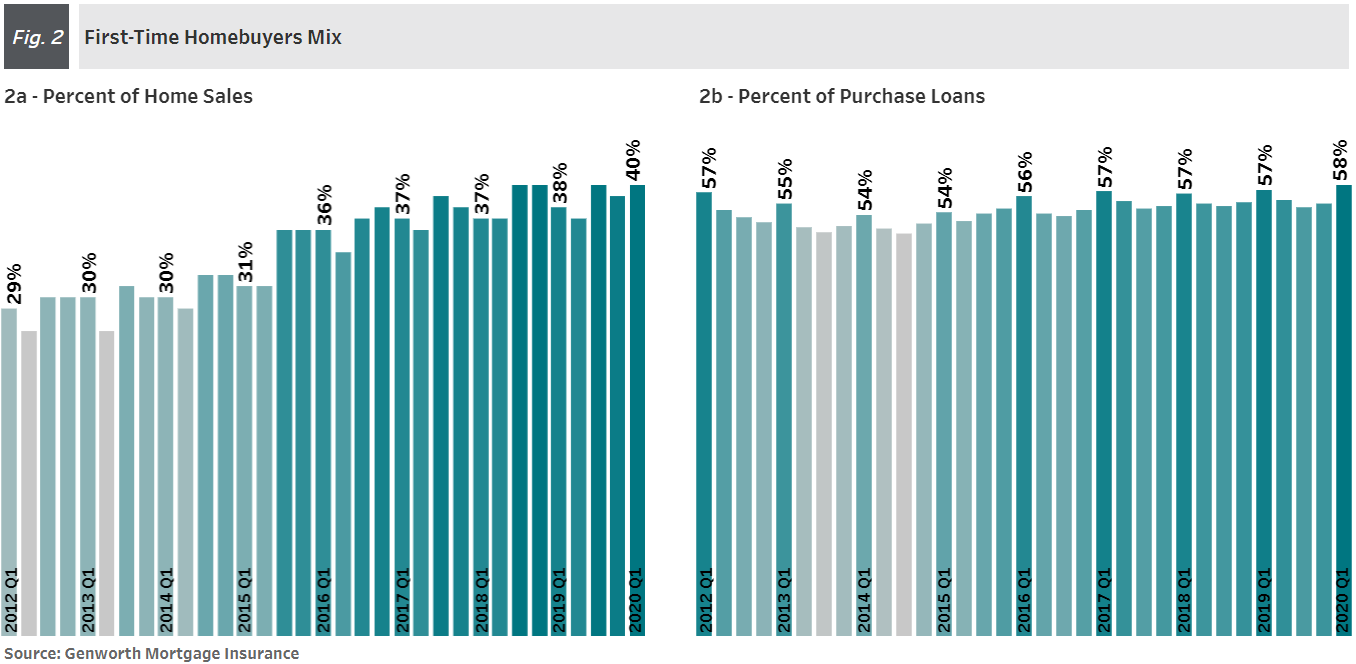

First-time homebuyers continue to represent a substantial part of overall activity in the housing market with 40 percent of all buyers in the single-family housing market (Figure 2a) and 58 percent of all purchase money borrowers (Figure 2b) in Q1 going to first-time homebuyers. Low-down payment conventional mortgages backed by private mortgage insurance continued to be a leading product for first-time homebuyers, helping to finance 139,000 first-time homebuyers in the first quarter, second to FHA’s 160,000.

The pandemic began to have a serious impact on the housing market in April as the number of confirmed cases increased, public awareness of the pandemic spread, and as states and local governments imposed stay-at-home orders and other restrictions. To understand the trend in the housing market between March and May, we use the rate lock volume data provided by Optimal Blue, a product pricing engine (PPE) used by mortgage lenders that lock around 34 percent of all completed mortgages.

The number of rate locks by potential first-time homebuyers decreased by 27 percent in April from March as the spread of COVID-19 reduced traffic by potential homebuyers and listings. At this stage of the pandemic, the first-time homebuyer market was less impacted compared to the repeat buyers’ market, which fell by 34 percent, in part because purchases by repeat buyers are often contingent on sales of their existing homes.

Widespread Impact in April

COVID-19 hit the first-time homebuyer market in most states, with 48 out of 51 states reporting lower sales in April compared to March. States that have been hit the hardest by COVID-19 saw significant decreases in the number of first-time homebuyers in April.

- New York, Pennsylvania, and Michigan saw month-over-month declines of over 50 percent.

- Iowa, North Dakota, and Nebraska were the only states that experienced positive month-over-month growth in first-time homebuyer activity.

- 48 states saw deeper declines in repeat-buyer activities compared to first-time homebuyer activities.

Tighter Credit Availability

The pandemic has resulted in tighter credit availability in the housing market, resulting in a sharp contraction in first-time homebuyers with riskier credit profiles or relying on mortgages that aren’t backed by Fannie Mae and Freddie Mac (GSEs).

- The number of first-time homebuyers taking out FHA loans decreased by 36 percent, and the market for jumbo loans decreased by 50 percent.

- The number of first-time homebuyers using other products have seen smaller declines. For example, the number of first-time homebuyers using mortgage insurance decreased only by 18 percent, and those using VA loans decreased by 23 percent.

- Credit availability decreased for borrowers with high debt-to-income (DTI) ratios and lower credit scores.

- For example, the number of first-time homebuyers with above 45 percent DTI decreased by 37 percent, compared to a decrease of 28 percent for borrowers with DTIs below 25 percent.

- The number of first-time homebuyers with credit scores below 680 decreased by 39 percent, compared to a decrease of 17 percent for borrowers with credit scores between 680 and 739.

Rapid Rebound in May

As the economy and businesses began to re-open in May, the first-time homebuyer market rebounded by 27 percent. The rebound was stronger for repeat buyers as they completed delayed sales. The repeat buyers’ market saw a 37 percent rebound over April.

- The rebound in May was widespread, with 50 states reporting positive month-over-month increases. New York, Pennsylvania, Vermont, Michigan, Colorado and Alaska saw month-over-month growth rates of over 50 percent in May.

- The number of first-time homebuyers rebounded across all mortgage products, with jumbo loan borrowers up 41 percent, FHA loan borrowers up 29 percent, and low down payment conventional loan borrowers up 24 percent.

- The number of first-time homebuyers with DTIs above 45 percent increased by 29 percent, while those with credit scores under 680 increased by 25 percent.

What We Learned

- The COVID-19 pandemic pushed the U.S. economy into the sharpest recession on record in March. The housing market also began correcting in April, with first-time homebuyer activities down almost 30 percent in just one month. However, what followed was a quick rebound in May of almost the same magnitude. This is not what we see in a typical recession and is a reason for the uncertain outlook.

- Repeat buyers were more impacted by COVID-19 in April than first-time homebuyers, in part because their purchases often are contingent on completing sales of their existing homes, which is a hurdle not faced by first-time homebuyers. First-time homebuyers only needed to buy a home. That is consistent with the stronger rebound in demand from repeat buyers as the economy and the housing market re-opens.

- Geographically, markets with a higher number of confirmed cases or with more strict lockdown policies, such as New York, Pennsylvania and Michigan, showed a deeper decline in first-time homebuyer activities in April, and a stronger rebound in May. These two facts tell us that the virus and the public health policy choices made in response can have material impact on the housing market.

- More typical in a housing downturn is that mortgage credit availability contracted in April, particularly for those reliant on two mortgage products, FHA loans and jumbo loans. Borrowers who relied on conventional loans were less affected. For first-time homebuyers, mortgage credit tightening has been focused on high DTI and low credit score borrowers. Both are consistent with the stories we have been hearing in the industry.

Very insightful analysis, especially with the state and local insight.