ARMs are on the Rise: A Look Inside How They Work

[This article is the second in our three-part series on adjustable-rate mortgages (ARMs). We’re diving into what ARMs are, how they work, and the situations in which a borrower might be interested in pursuing one. To access the rest of the series, click here.]

In our first article in this series, we talked about why adjustable-rate mortgages, or ARMs, have become more attractive to homebuyers as interest rates continue to rise. We also provided some basic information about what an ARM is, as it has been some time since these products were as popular as they are today.

Now that you hopefully have a basic understanding of ARMs, let’s delve deeper into how they work, so you can better help your borrowers to determine if an ARM is right for them.

Indexes and Margins

As we explained in our first article, the interest rate on an ARM changes over time, but every ARM starts with a fixed initial rate for a specific period of time, usually 3, 5, 7 or 10 years. After the initial rate period, every rate adjustment is tied to a particular market index for the entire term of the loan. As the index changes, so does the rate.

Until recently, the index used for most ARM products was the London Interbank Offered Rate, or LIBOR. Then in 2019, Congress replaced LIBOR as the default lending index with the Secured Overnight Financing Rate, or SOFR, which is calculated differently and considered less risky. SOFR is based on the U.S. Treasury repurchase market, where Treasuries are loaned and borrowed overnight. The SOFR is published daily by the New York Fed. You can find it here.

There are different versions of the SOFR index, but most ARMs are calculated based on the 30-Day Average SOFR index. To set the initial rate for an ARM, the lender takes the index and adds a number of percentage points to it, or a margin. The margin amount can vary depending on the borrower’s credit rating and other factors. A borrower with great credit is usually entitled to a smaller margin, and thus a lower rate.

The index plus the margin creates the fully indexed rate, which is the interest rate the borrower will pay.

Understanding Caps

Obviously, no one knows what will happen with the SOFR index or interest rates in the future. And if an ARM rate adjusts too high, the borrower may not be able to afford their mortgage payment.

Fortunately, there are caps on ARM loans that limit how much the borrower’s rate can change over time, which takes some of the uncertainty out of the picture.

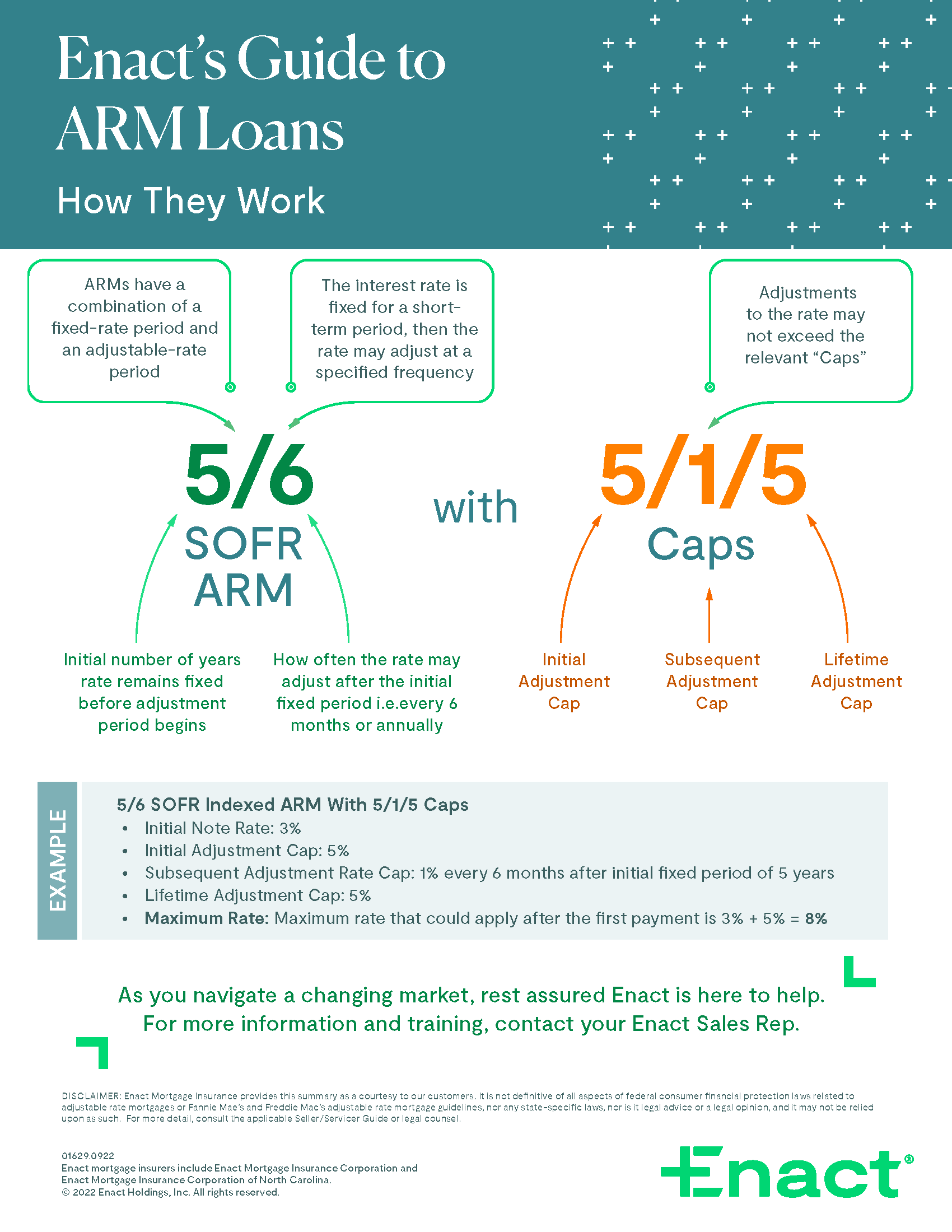

To see how this works, let’s take a 5/6 SOFR ARM, which is a loan that has a fixed initial rate for five years before adjusting once and then adjusting every six months after that.

Now let’s suppose the 5/6 SOFR ARM starts out with a fully indexed rate of 3% and has caps of 5/1/5. The first “5” represents the initial adjustment cap, which is 5%. The “1” refers to each subsequent cap, which is limited to 1% every six months. The second “5” is the lifetime adjustment cap, or 5%.

So, if we start out with an initial rate of 3%, the maximum rate the ARM can adjust to is 8% over its lifetime. This means that even if the SOFR index pushes the fully indexed rate up to 9%, the borrower will never pay more than 8%.

In addition, every borrower who gets an ARM typically qualified at the note rate plus an “additional” percentage based upon the ARM type and initial adjustment cap.

Even though your clients must qualify at a higher rate than the note rate, many borrowers don’t think rates will reach as high as the maximum rate. It’s important to explain to them that there’s no guarantee what rates will do in the future, and that they should prepare for this possibility.

Want to Learn More?

In our third post in this blog series, one of our loan experts will offer some tips on advising your clients on ARMs. In the meantime, feel free to reference our flier on ARMs basics and share it with your clients. And because going the extra mile for our customers comes naturally to us, we even offer a training course on ARMs, too.

We offer coverage for most ARM loans at very competitive rates. We’re also dedicated to seeing every one of your transactions to the finish line and beyond. For more information, simply contact your Enact Sales Rep.

You can also access our Enact’s Guide to ARM Loans: How They Work flier below – it’s a great resource to reference for you and your borrowers. Never miss a post by subscribing to the Enact MI Blog! We’ll send you our most up-to-date topics right into your inbox.

Never miss a post by subscribing to the Enact MI Blog! We’ll send you our most up-to-date topics right into your inbox.

Leave a Reply

Want to join the discussion?Feel free to contribute!