Get to Know MI Premiums: Single Premium Borrower-Paid Mortgage Insurance (BPMI)

Every borrower’s financial situation is different. So, at Enact, we offer a variety of MI premium payment plans to help you find an option that is best for your borrower. It’s important to get to know the many different MI premium options available to your borrowers. In this post, we’re highlighting Single Premium Borrower-Paid Mortgage Insurance (BPMI) and providing some examples of borrower scenarios.

So, what is a BPMI Single Premium?

BPMI Single Premiums Explained

This one-time premium payment could result in a lower monthly mortgage expense for your borrower. The coverage remains in effect until cancelled in accordance with federal and state cancellation laws, investor requirements or Enact’s Master Policy.

What are the Benefits?

This list is not exhaustive but provides great insight into some of the benefits of choosing Single Premium BPMI for your borrowers.

Flexibility at Closing

There are multiple ways to pay for the MI premium such as additional borrower funds, seller concessions, lender/builder credit or financing the premium into the loan amount.

Lowest Mortgage Payment with Borrower-Paid Product

The absence of a monthly MI payment often provides a lower monthly payment than other plans. It may also offer lower monthly payment than FHA Loans.

Cancelable

Borrowers may request cancellation in accordance with the Homeowners Protection Act of 1998 (HPA) or investor guidelines.

Refundable and Non-Refundable Options

Lenders have the option to choose between two types of BPMI Singles: refundable and non-refundable. Refundable single premiums may receive a refund of unearned premium at cancellation according to the applicable refund schedule. Non-refundable single premiums generally do not receive a refund at cancellation; however, where the MI is canceled in accordance with the HPA, there will be a refund of any unearned premium. For more information on the HPA’s requirements, please consult your legal counsel.

Note: Premium rates between refundable and non-refundable singles may vary for the same risk characteristics.

What are some Key Considerations?

These premiums are best for borrowers who want to:

- Minimize their monthly mortgage payment

- Leverage seller or builder credits to pay the MI premium – especially in a buyer’s market

These premiums may not be the best option for borrowers who:

- Are in a falling interest rate environment

- Are expecting an inheritance or other large sum of money in the near future that they may plan to use to payoff the loan in full

- Have reason to believe they might refinance or pay off the loan within a few years of loan close

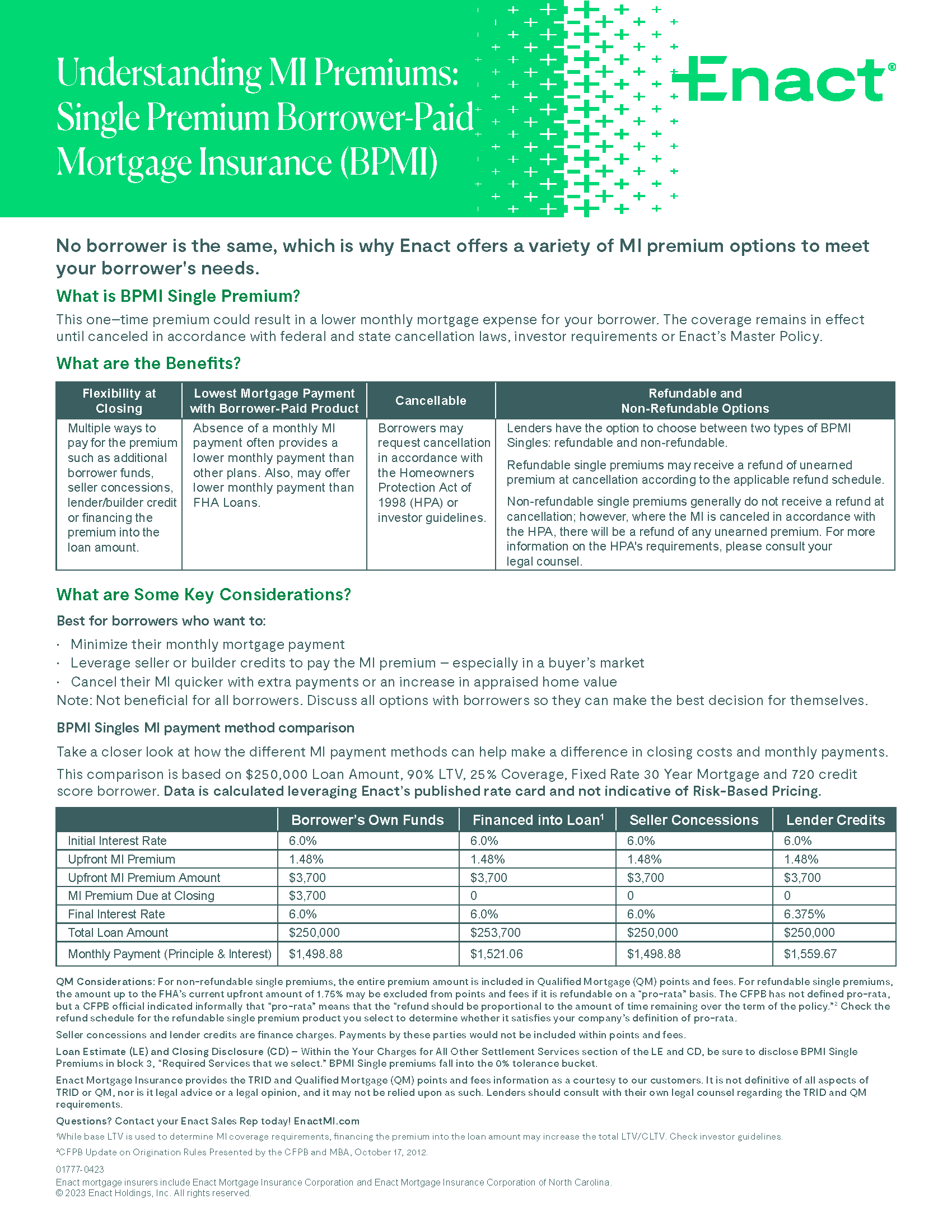

BPMI Singles MI payment method comparison

Take a closer look at how the different MI payment methods can help make a difference in closing costs and monthly payments.

This comparison is based on $250,000 Loan Amount, 90% LTV, 25% Coverage, Fixed Rate 30 Year Mortgage and 720 credit score borrower. Data is calculated leveraging Enact’s published rate card and not indicative of Risk-Based Pricing.

| Borrower’s Own Funds | Financed into Loan¹ | Seller Concessions | Lender Credits | Monthly Premium Plan | |

| Initial Interest Rate | 6.0% | 6.0% | 6.0% | 6.0% | 6.0% |

| Upfront MI Premium | 1.48% | 1.48% | 1.48% | 1.48% | NA |

| Upfront MI Premium Amount | $3,700 | $3,700 | $3,700 | $3,700 | NA |

| MI Premium Due at Closing | $3,700 | 0 | 0 | 0 | 0 |

| Final Interest Rate | 6.0% | 6.0% | 6.0% | 6.375% | 6.0% |

| Monthly MI Premium | NA | NA | NA | NA | 0.46% |

| Monthly MI Premium Amount | NA | NA | NA | NA | $96.00 |

| Total Loan Amount | $250,000 | $253,700 | $250,000 | $250,000 | $250,000 |

| Monthly Payment (Principal & Interest) | $1,498.88 | $1,521.06 | $1,498.88 | $1,599.67 | $1,594.71 |

1While base LTV is used to determine MI coverage requirements, financing the premium into the loan amount may increase the total LTV/CLTV. Check investor guidelines.

BPMI Single Premium Fictional Examples Explored

Read about the following borrower scenarios told through examples of BPMI Single Premium fictional personas.

| #1 | #2 | #3 | #4 |

| “I had a borrower with a DTI that was over the threshold, making them ineligible. As their loan officer, I recommended changing to a single premium with a lender credit for their mortgage insurance (MI) instead of the normal monthly payment plan. I explained that by moving the interest rate from 6.0% to 6.375%, we could provide a lender credit to cover the mortgage insurance. By doing this, we were able to get their DTI below the threshold. This was a great strategy to help get the borrower into their new home! It even brought their payment down slightly from $1,594.71 to $1,559.67! | “I really try to explain all the available options to my borrowers. On one loan, I explained that the borrower could finance a single premium for their mortgage insurance (MI) into my loan, which would increase it from $250,000 to $253,700. The borrower really liked that this would maintain their original interest rate and wouldn’t require any additional funds for MI at closing and dropped their monthly payment by over $70! I had to be mindful that it would apply to QM points and fees, but we were well within range.” | “One of my borrowers found a really great home! The seller even provided $3,700 in concessions. As their loan officer, I provided some insight into how they can best use the funds for their loan. I knew they were going to need mortgage insurance, so I recommended using a single premium for their MI, which would be covered by seller concessions. We wouldn’t need any additional funds for MI at closing, keeping the same interest and loan amount. Since this had the potential to impact QM points and fees, I carefully reviewed the loan and connected with my team to ensure everything would work out.” | “I had a borrower who wanted to create a plan to deal with the rising interest rates. I suggested to address this is by selecting a refundable single premium for my mortgage insurance. Though it would require more funds from the borrower at closing, he was planning to refinance in the future, which would grant a portion of the funds to be refunded based on the applicable schedule. After some discussion, we felt comfortable moving forward with this approach.” |

Not every borrower’s homebuying experience may fit in like the examples above. As always, it’s important to discuss all the options with your borrowers and get the most complete picture you can of your borrower’s individual situation so you can help them make the decision that works best for them. However, these personas can provide some context on the ways in which lenders and loan officers may find that BPMI Single Premiums are the best option for their borrowers.

It’s important to remember that for each borrower situation, you should check investor guidelines and consult with your own legal counsel regarding Qualified Mortgage (QM) requirements.

Need a reference guide to help you remember the information we’ve shared here? Download our BPMI Single Premiums Flier now!

Want to learn more?

Our dedication to helping borrowers achieve the dream of homeownership doesn’t stop here — we offer training resources to help you work with your customers to your max potential.

And, if you want to learn more about ways to better aid your borrowers or need some extra insight, you can always contact your Enact Sales Rep for more info too. They’ll be happy to help you meet your business needs, answer questions, and point you in the right direction.

Never miss a post by subscribing to the Enact MI Blog! We’ll send you our most up-to-date topics right into your inbox.

Leave a Reply

Want to join the discussion?Feel free to contribute!