Ask an RU: How HFA and DPA Programs are Helping Tackle Affordability Issues

Affordability has been top of mind for many in the housing industry, yet homeownership for many low to moderate income prospective borrowers feels out of reach. That’s why those of us in the mortgage industry understand the importance of assisting qualified borrowers to responsibly achieve the dream of homeownership, regardless of income level. One avenue to assist these potential applicants is with State Housing Finance Agency (HFA) programs. HFAs especially work well with First-Time Homebuyers (FTHBs) and lower-income markets!

Our very own Donna Muratalla, Regional Underwriter, dives into what HFAs are, how they can help borrowers combat affordability issues, and the various programs like down payment assistance that HFAs offer.

What are HFAs?

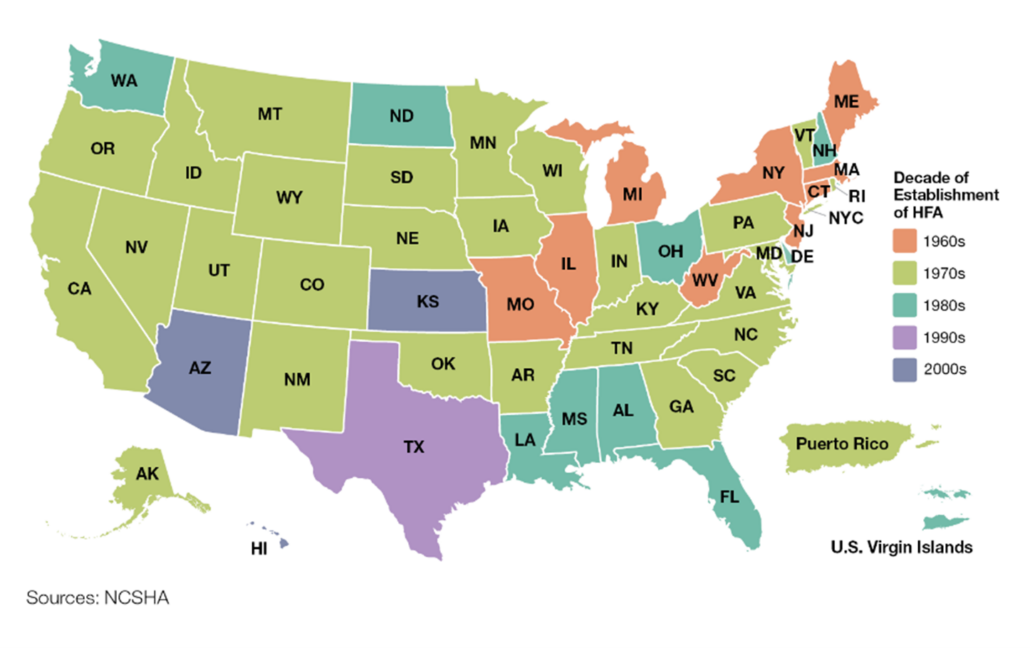

For over 50 years, state housing finance agencies, also known as HFAs, have played a central role in the nation’s affordable housing system. HFAs are state-chartered, nonprofit organizations that provide financing and services to help meet the affordable housing needs of the residents of their states. Although they can vary in characteristics, such as their relationship to state government, most HFAs are independent entities that operate under the direction of a board of directors appointed by each state’s governor. They administer a wide range of affordable housing and community development programs.

HFAs have provided affordable mortgages to more than 3.4 million families to buy their first homes through the single-family Housing Bond program and other financing programs. They have delivered more than $500 billion in financing to make possible the purchase, development, and rehabilitation of more than 7.5 million affordable homes and rental apartments for low- and middle-income households, according to National Council of State Housing Agencies (NCSHA).

Most HFAs are self-supporting, operating in the capital markets without the financial backing of their respective state and generating their own resources to fund their activities. Each state HFA in its own way, combines the financial tools and business discipline of a large-scale lending institution with the planning and policy-making responsibilities of a mission-oriented, public-purpose agency.

What are the goals of HFAs?

HFA homeownership programs vary by state, but their common goal is promoting homeownership and increasing mortgage affordability for first-time homebuyers and low- and moderate-income households.

These programs include low interest-rate, low down payment mortgage products, as well as down payment and closing cost assistance (distributed by the HFAs as well as local municipal and nonprofit organizations with whom they work). They also include mortgage tax credit certificates, which are dollar-for-dollar federal tax credits in connection with home loans.

How HFAs are working to assist all borrowers:

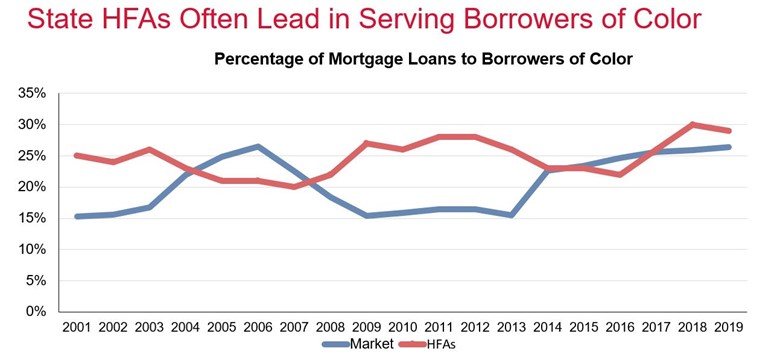

Programs like these are finding ways to help bridge the homeownership gap for minority borrowers, as affordability continues to be an obstacle. State HFAs are drivers of homeownership for borrowers of color, as reflected in the minority borrowers’ shares of HFA homeownership financing in states such as:

- CA – 65%

- DC – 79%

- GA – 61%

- LA – 56%

- TX – 77%

Source: Home Mortgage Disclosure Act Data from Consumer Financial Protection Bureau, NCSHA

Source: Home Mortgage Disclosure Act Data from Consumer Financial Protection Bureau, NCSHA

Each HFA is responsible for identifying the needs of the community to better develop and cater programs to those communities. Ensuring you know the ins and outs of programs like HFAs will help you more effectively navigate supporting underserved housing markets.

How do the GSEs handle HFA loans?

The GSEs work with HFAs to help bridge the affordable housing gap. Fannie Mae’s HFA program is HFA Preferred™ and Freddie Mac’s HFA program is HFA Advantage®. Both programs allow fixed-rate mortgages with a minimum down payment of 3 percent for primary purchases or rate and term refinances, or 5 percent down for 2-4 units and standard manufactured homes.

You can often finance the down payment with a down payment assistance program (DPA), which is provided through the HFA. The DPA could be a second mortgage, or a forgivable loan that’s subordinate to the first mortgage and used to cover down payment and closing costs. It wouldn’t need to be repaid in full or in part if you meet certain conditions, depending on the program. DPA could even be an outright grant (such as HFA Preferred™ grants), depending on what that particular state authority offers. Often, this assistance is only available if you are financing with an HFA loan.

GSE HFA loan requirements:

To qualify for one of these mortgages, borrowers generally must meet a few basic HFA loan requirements:

- 97% LTV for single-family, condos and Fannie Mae’s manufactured MH Advantage homes

- 95% LTV for 2-4 units and standard manufactured homes

- 105% CLTV with community seconds (excluding manufactured homes)

- DU/LPA or manual underwrite is permitted

- Debt-to-income ratio max of 45% on a manual underwrite

- Reduced mortgage insurance coverage for borrowers with less than or equal to 80% AMI

- Primary residence

Local HFA programs may have additional minimums borrowers must meet. Often, they need to be within certain income and purchase price limits that vary by county/municipality and household size. And, borrowers will have to buy their prospective home in the same state as the HFA program.

For more information on Fannie Mae’s HFA Preferred™ training, guidelines, and fact sheet, access their site here. If you’d like to learn more about Freddie Mac’s HFA Advantage® program, access their resource center here.

How DPA and other aid programs work with HFAs

Down payment assistance (DPA) programs help homebuyers navigate down payment and closing costs, helping them save money and purchase a home sooner. Most down payment offerings are administered at the local level through state, county and city government agencies. These funds come in the form of a loan, grant, or matched savings, though some federal programs have offerings too. Program eligibility is typically based upon a specific set of qualifications and requirements that the homebuyer must meet. These qualifications vary by program.

Learn more about state HFA programs:

State HFA programs, as well as community programs, offer down payment assistance in the form of grants or a second mortgage loan to cover down payment and/or closing costs for low- and moderate-income, first-time homebuyers. For additional information on HFAs, learn more on the National Council of State Housing Agencies website.

There are over 2300 HFA and Down Payment Assistance programs as of March 2024;

- 81% of DPA programs have deferred payments

- 53% are forgivable loans

- 50% are forgivable loans with deferred payments

And with more DPA programs created each year, that’s more borrowers who are able to be helped. Staying up to date on the available programs, resources and tools will help you more effectively support your underserved markets.

Plus, the GSEs also provide helpful insight and tools to help you more effectively navigate cost assistance for your borrowers. Check out Fannie Mae’s Down Payment Assistance Tool that you can send to your borrowers directly to use, and Freddie Mac’s DPA One hub to help you quickly find, understand and match DPA programs for borrowers.

Here is another type of aid program:

HFAs also manage a tax credit program, which is designed to help first time homebuyers offset a portion of their mortgage interest on a new mortgage. Mortgage Tax Credit Certificates (MCCs) reduce the borrower’s federal tax liability, dollar for dollar, by a specific percentage of the mortgage interest paid by the borrower. MCCs can be combined with a variety of mortgage loan products including conventional and government low-down payment products.

While it may take some additional effort, researching and securing down payment assistance funds for your borrower is well worth it! If you have any questions on HFA and DPA programs, feel free to contact our Regional Underwriting Team or contact your Sales Representative today.

More ways we can help

When working with borrowers who face affordability obstacles, your Enact MI team has got you covered. They can answer any of your important questions about HFA and DPA programs. Our Regional Underwriting Team is available to assist you Monday-Friday 8am to 8pm ET at 800-444-5664 option 2.

Be sure to make the most of your MI experience, too. Please explore our many underwriting resources and underwriting tips for more information. Because going the extra mile comes easy for us, we also offer a comprehensive suite of training resources to help boost your industry experience.

Source: Donna Muratalla is a Regional Underwriter for Enact.

Never miss a post by subscribing to the Enact MI Blog! We’ll send you our most up-to-date topics right into your inbox.

Leave a Reply

Want to join the discussion?Feel free to contribute!