Breaking Down GSEs’ 97 LTV Loan Programs and How Enact MI Can Help

Purchasing a home can be an exciting, but daunting process for your borrowers and each one brings something different to the table. We align with Freddie Mac and Fannie Mae’s 97% loan programs by insuring 97 LTV loans and protecting you and your borrower.

If your borrower requires PMI for their loan, we at Enact have specific guidelines that apply depending on your borrower’s situation. You can find more detailed information in our Underwriting Guidelines.

In this post we will dig into the details of the agency 97 LTV loan programs that apply for lower-income (those with total qualifying income no more than 80% of AMI) and first-time borrowers. For more information on the product guidelines and eligibility requirements of these programs, be sure to refer to Freddie Mac’s Seller/Servicer Guide and Fannie Mae’s Selling Guide.

The 97 LTV Loan Rundown:

When working on 97 LTV loans with your borrowers, and understanding their unique situations, you need to familiarize yourself with the specifics of each GSEs’ guidelines and eligibility requirements.

This list is not exhaustive and provides quick highlights of some of the details you’ll need to know when working on these loan originations.

Programs for lower-income borrowers:

Programs:

- Fannie Mae HomeReady®

- Freddie Mac Home Possible®

First-Time Homebuyer (FTHB):

- Not required

Loan-Level Price Adjustments (LLPAs):

- LLPAs waived

Credit Score:

- 620

Purpose/Property Types:

- Purchase & Rate/Term Refi 1 unit 97% LTV (2-4 units at lower LTVs)

- 1-unit only if: Condo, Co-op, Manufactured Housing & Renovation (95% LTV)

Programs for first-time borrowers:

Programs:

- Fannie Mae Standard 97% LTV

- Freddie Mac HomeOne®

First-Time Homebuyer (FTHB):

- At least one borrower must be a first-time homebuyer

Loan-Level Price Adjustments (LLPAs):

- Standard risk-based

- Waived for Loans to First-Time Homebuyers at or below 100% of area media (or 120% in high cost areas)

Credit Score:

- 620

Purpose/Property Types:

- Purchase & GSE owned Rate/Term Refinance 1-unit owner occupied primary residences

- All property types (except manufactured housing); C-to-P eligible

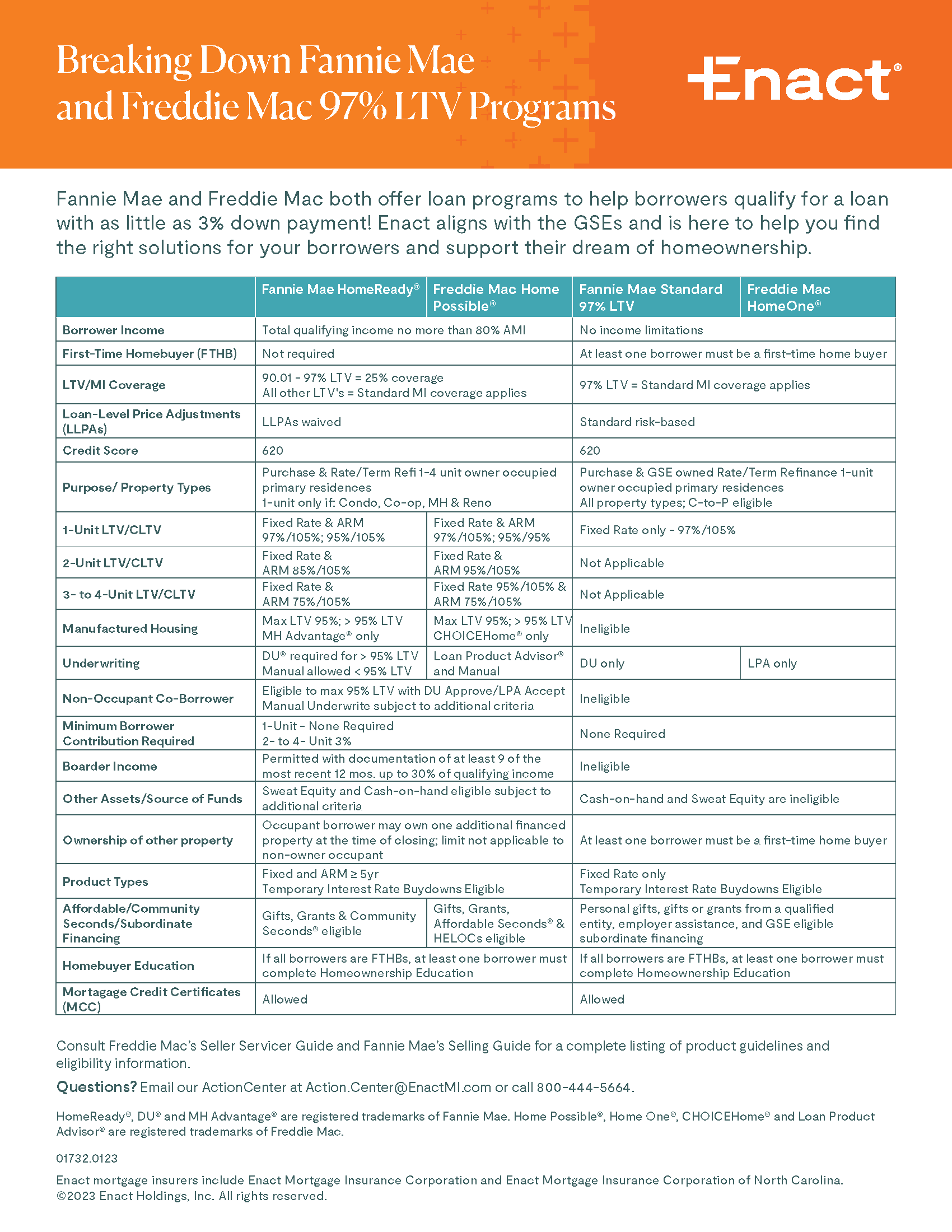

Our guidelines can provide extra insight and we even have an overview flier, Breaking Down Fannie Mae and Freddie Mac 97% LTV Programs, that you can use to help you reference more details about the GSEs’ programs that we’ve highlighted here.

Enact Can Help:

We insure 97 LTV loans in order to protect you and your borrowers. Here’s a quick snapshot of the GSEs’ coverage requirements that we offer:

Lower-income borrowers:

- 97% LTV*: Standard Coverage at 25%

First-time borrowers:

- 97% LTV: Standard Coverage at 35%

*Lower-income borrowers with 90.01-95% LTV loans can also utilize Standard Coverage of 25% to meet GSE coverage requirements.

Download our Breaking Down Fannie Mae and Freddie Mac 97% LTV Programs today!

Want to learn more?

You can always refer to our Underwriting Guidelines for a more in-depth look at Enact’s guidelines for 97 LTV loans. Our dedication to helping borrowers achieve the dream of homeownership doesn’t stop here — we offer training resources to help you help your borrowers too.

We also have a downloadable flier, Breaking Down Fannie Mae and Freddie Mac 97% LTV Programs, that provides a useful breakdown of some of the specifics between programs for lower-income and first-time borrowers. Whether you’re new to this career or an expert, it’s important to stay in the know and access the most up-to-date information available – be sure to refer to Freddie Mac’s Seller/Servicer Guide and Fannie Mae’s Selling Guide.

And, if you want to learn more about these 97 LTV loans or need some extra insight, you can always contact your Enact Sales Rep for more info too. They’ll be happy to help you meet your business needs, answer questions, and point you in the right direction.

Never miss a post by subscribing to the Enact MI Blog! We’ll send you our most up-to-date topics right into your inbox.

Leave a Reply

Want to join the discussion?Feel free to contribute!